A digital evolution for a promising future in agriculture

Evelyn Seltier of Trade Forum checked in with Michael Ocansey, the winner of the first-ever ITC pitching contest in 2017, to hear how his company Agrocenta has evolved since then. This start-up set out to support smallholder farmers by connecting them to big buyers, but seven years later things have changed.

Learning and constantly adapting your business model are key, says Michael. Read how his digital platform transformed to offer financial services, which impact the lives of hundreds of thousands of farmers in rural Ghana.

Smallholder farmers don’t always have much choice when it comes to selling produce at the best price. They often don’t find the right markets or buyers and risk being exploited by middlemen. And if they want to expand their farmland to increase revenue or meet buyers’ demands, they usually don’t get financial support, because living in rural marginalized or poor communities means that banks don’t trust them enough to give out loans.

Yet these farmers are the bread and butter of their respective countries – often literally.

People like Michael Ocansey from Ghana have decided to change this narrative.

In Ghana, over 50% of the labour force is engaged in agriculture. Agriculture contributes to 54% of Ghana’s GDP and accounts for over 40% of export earnings, while providing over 90% of the food needs of the country. A little over 70% of the people employed in the agricultural sector are smallholders living in rural areas, who engage in traditional and rain-fed practices.

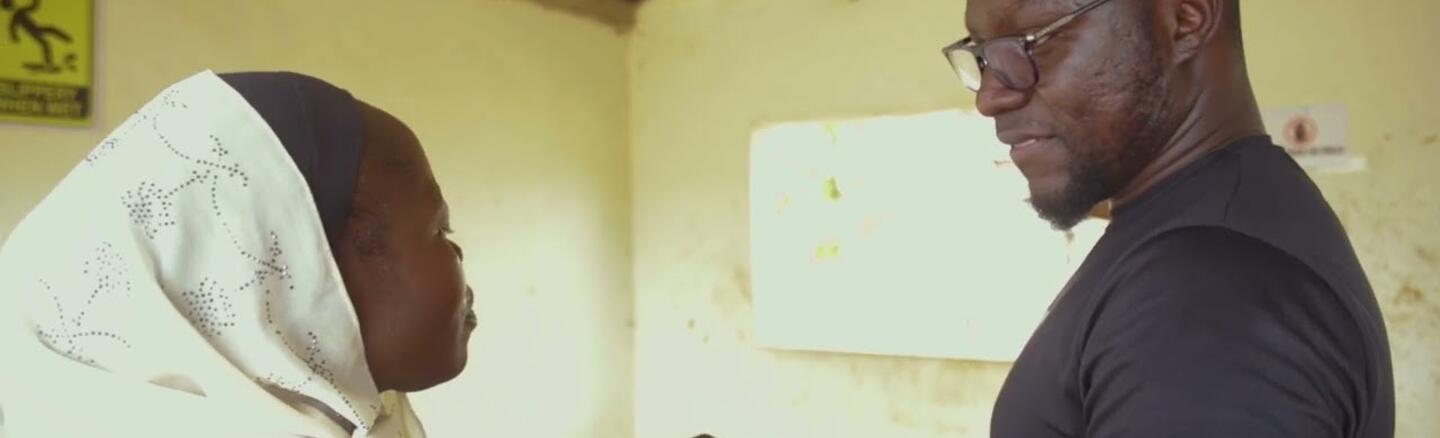

Since 2015, Michael and his business partner Francis Obirikorang have been trying to learn what the pain points of smallholder farmers in northern Ghana are, and how these could be addressed to improve their lives.

And they have learned a lot since then.

In the beginning, the two start-up pioneers tried to address market access directly. By offering a platform for buyers, they sought to cut out the middleman, linking buyers directly to farmers to order large volumes.

This is how Agrocenta was born in 2016. During the first quarter of 2017, the co-founders dedicated their time to on-boarding farmers and signing contracts with four large buyers. In May 2017, they started purchasing commodities from their farmers using an online platform, Cropchain.

By the end of 2017, AgroCenta had bought commodities worth $120,000 from 3,000 smallholder farmers at prevailing market prices or higher. As a result, farmers made four times more than they used to and payments were prompt: 100% up front. At that point, many of the smallholders were able to look after their families better and reinvest some money.

However, the business model turned out to be difficult to sustain.

“The journey has been full of learning on the job. Over time we realized that some things needed to change. For instance, as a start-up we needed cash immediately. But as we had to pre-finance the commodities while waiting for 45 days to be paid by the buyer, constantly pumping money into our commodities purchases got very expensive.”

Another challenge was that the farmers couldn’t meet the demand of the buyers. Why? Because most smallholder farmers only cultivate one or two acres of land.

“The farmers told us, ‘We have the farmland, but my money can get me as far as two acres’. So, we asked them, ‘Why don’t you expand through a loan?’ ‘Well, the financial institutions say that we are high risk. We can’t prove to the bank that we have money because all payments are cash-based’.”

To help them access finance and make the farmers credit-worthy, Michael introduced mobile money payments. Their digital platform started providing a financial trail for every farmer that served as a bank statement. Partnering financial institutions were then able to access this data to make informed decisions and provide credit or loans to the farmers.

Video

Fast forward to 2020. When COVID-19 hit, Michael and his partner took a third look at their business model as market access was low. They wanted to build on their existing financial solutions to help the farmers even more.

This is how their current financial services platform came into being. Digital payments for smallholder farmers enable access to loans. Agrocenta has also introduced digital pension and saving options for smallholder farmers, who, when they retire, often don’t know how to survive.

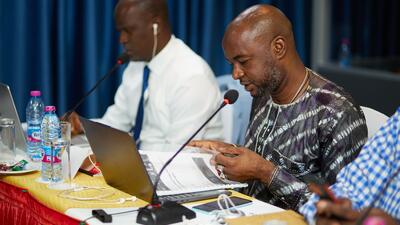

“Over the years, NGOs have been looking for technical partners. And lucky for us, we have been part of Mastercard Foundation’s four projects in Ghana and working together with Enterprise Trustees – which validated us as a trustworthy partner.”

Another challenge Michael and his partner observed was that most smallholder farmers they work with cannot read or write – and do not have smartphones to use their app. To reach this demographic, they hired field agents, who have a diploma or degree in agriculture, and who could use the application on behalf of the farmers.

Michael noticed that the cooperatives now have increasingly younger members. “Youth are interested in agriculture, as they see potential revenue in owning farms and exporting. They are literate and tech-savvy, owning a smartphone, and know how to use our technology. So instead of relying on an agent, we now use young tech-savvy members of the cooperative to input all information on the platform. We call them Digital Committee Members.”

This approach has helped Agrocenta reduce their reliance on field agents, saving money on phones and time, while providing jobs for 700 youth in the farming communities.

Today, Agrocenta focuses on empowering cooperatives by helping them get registered and enabling the right governance structure. This provides cooperatives with more leverage to access finance and help women own land for farming.

“We want to expand to the other eight regions in Ghana and to other commodities. We are still fundraising and hope to close before the end of this year.”

Currently, Agrocenta has 300,000 smallholder farmers on the platform and a presence in Burkina Faso. Their goal is to reach 800,000 farmers by the end of 2024, then 1.5 million by end of 2025.

“Our main goal has always been to help smallholders transform into commercial farmers, as this increases their income and then enables them to reinvest more into their business. When we manage that, we will know that we have succeeded as a company.”

“Joining pitching competitions is great for you as it gives you visibility and can unlock doors for more funding. If you should win, the prize money also helps you to not lose much equity.

It is also okay to pivot if your original business model isn’t cutting it anymore. The business model we started out with in 2017 is very different from what we have today in 2024.”